New York — The U.S. jewelry market in 2025 is breaking all expectations. After years of inflation, economic uncertainty, and shifting consumer habits, both luxury giants and value-driven brands are reporting solid growth. But for the mid-tier players—the likes of Signet Jewelers and Brilliant Earth—a clear message is emerging: the middle ground is collapsing.

While Richemont’s Americas sales jumped 17% and Pandora’s U.S. business grew 12% year-on-year in Q2, mid-tier brands only managed around 3% growth. Still, even that modest rebound signals a stabilization after several turbulent years. The challenge now is strategic: will these brands chase volume or defend value?

The Polarization of the Market

At the top, luxury houses such as Richemont and LVMH are reinforcing their dominance through heritage, exclusivity, and an unwavering focus on natural diamonds. At the bottom, Pandora is proving that affordability and accessibility still win hearts, leaning into lab-grown diamonds and expanding through massive scale.

The squeeze is on the middle. Once the backbone of the American jewelry landscape, mid-tier brands now face eroding margins and confused identities.

Signet Jewelers, under new CEO J.K. Symancyk, is executing a dual-track strategy: lab-grown for fashion jewelry volume, and natural diamonds as the emotional and financial anchor of its bridal line. It’s a play to maintain credibility in both categories without blurring the message.

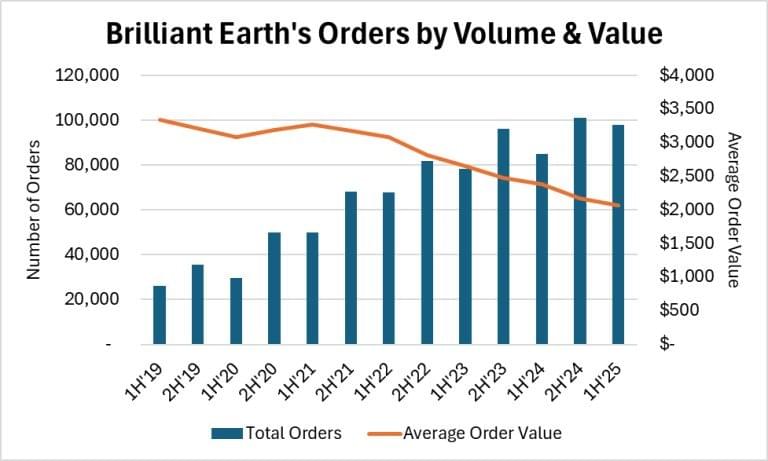

Brilliant Earth, however, seems to be drifting toward the high-volume, lower-value model. Its average order value dropped from $3,340 in 2019 to $2,068 in 2025, largely due to the explosive 38% growth of its fine jewelry segment—priced lower than bridal. CEO Beth Gerstein attributes the trend to demand for engagement rings under $5,000 and a growing preference for lab-grown stones.

This strategy boosts transaction volume but risks diluting brand positioning. “Lab-grown diamonds were meant to be a choice, not a substitute,” one analyst noted, “but for Brilliant Earth, they’ve become the main driver of growth.”

A Shrinking Middle

Independent U.S. jewelers find themselves caught in the same trap: mixing lab-grown and natural diamonds to please everyone—only to weaken both narratives. As a result, the mid-market is fragmenting faster than ever.

Avi Krawitz

Luxury retailers and budget-friendly brands have both found their lanes and doubled down. Meanwhile, the “in-betweeners” must make a choice—fast.

Avi Krawitz, who has been tracking these shifts closely, writes that the true test for 2025 isn’t recovery, but clarity. “Jewellers can no longer straddle both sides,” he says. “They must decide whether to build on value or chase volume. The market will reward whichever strategy is pursued deliberately.”

In short, the American jewelry industry isn’t just rebounding—it’s reinventing itself. And in this new landscape, hesitation might be the most expensive accessory of all.

👉 Explore AIDI’s Jewelry Market Insights — uncover how U.S. retailers are redefining value, volume, and the future of diamonds in 2025.