Profits have been falling every year since 2021 for Britain’s biggest national jewelers, exclusive WatchPro analysis reveals.

The alarming slump in margins began after a steep rise in sales and profits as the country and retail industry emerged from the first year of covid lockdowns.

This led to a gold rush of investment in new and larger stores, many of them boutiques for the world’s biggest watch brands, and a flurry of expensive refurbishments.

Retailers have also been upgrading their services and the expertise and qualifications of their teams.

Green-lighting this investment, which intensifed in the United States in the same period, looked like a sure bet back in the boom years of 2021 and 2022, but returns have been disappointing.

Studyong the turnover and profits of the top 15 retailers specializing in watches and jewelry in the UK gives a fascinating insight into the challenges that may face businesses on this side of the Atlantic.

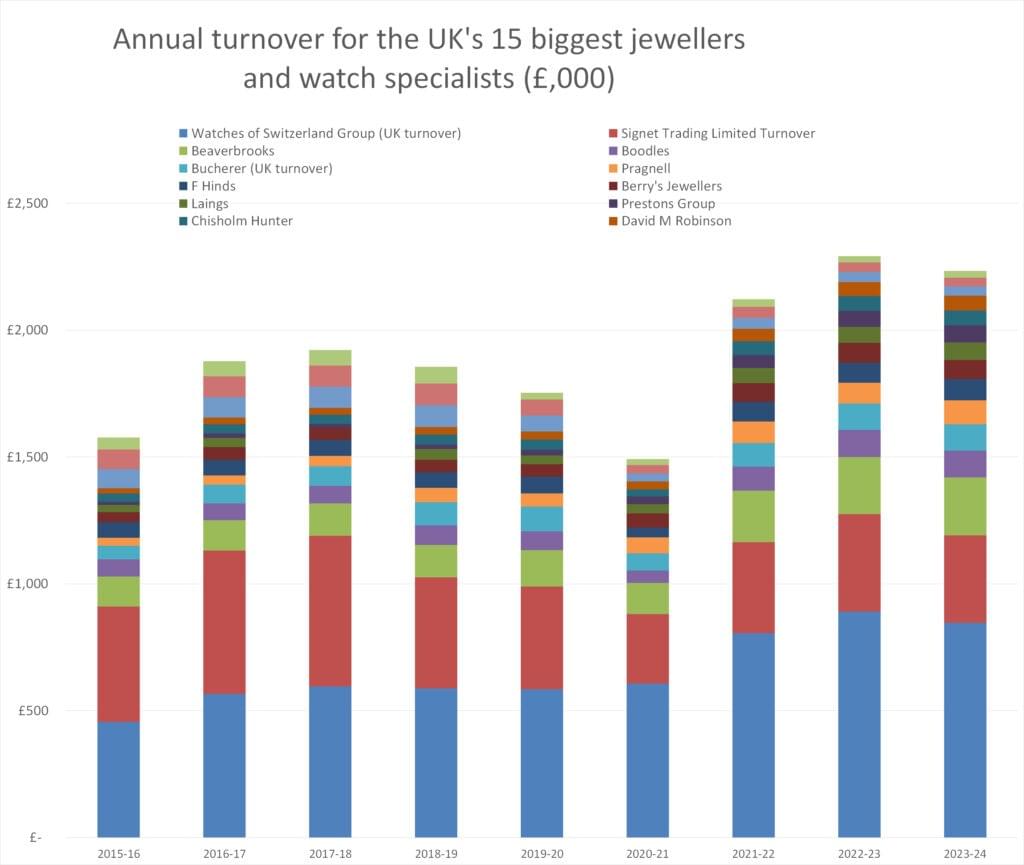

Accounts show they collectively hit a new record for sales in 2022-23 of £2.29 billion (financial years vary, but they mainly run spring-to-spring), before falling back slightly in 2023-24.

Accounts filed at Companies House show how the top 15 jewellers operating in the UK bounced back from the covid years with record sales. (editor’s note: Bucherer’s UK turnover for 2023-24 has been estimated at £104m, the same as the prior year, because its accounts have not yet been filed.)

Despite sales dipping by a mere 2.5% in 2023-24, profits have plunged, particularly in the mid-market and volume sectors of the market.

Chisholm Hunter, Beaverbrooks, TH Baker, Fraser Hart, F. Hinds and CW Sellors — every national jeweler examined by WatchPro is showing the same trend.

Sales are holding up reasonably well, but profits are falling year after year.

Chisholm Hunter, which has a strong portfolio of Richemont and Swatch Group brands, has relentlessly grown sales over the past 15 years, bar a slump during the first year of the pandemic.

Profits peaked in 2021-22 at £8 million, more than double its previous best year of 2013-14, and were down to just over £3 million in its most recently reported financial year despite sales holding strong at £58 million.

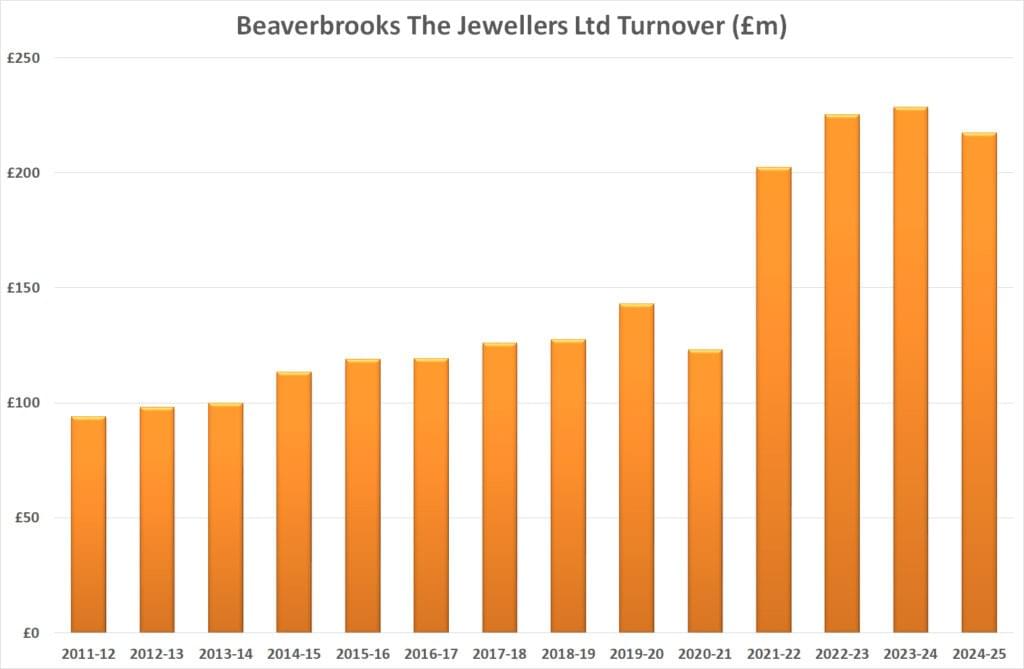

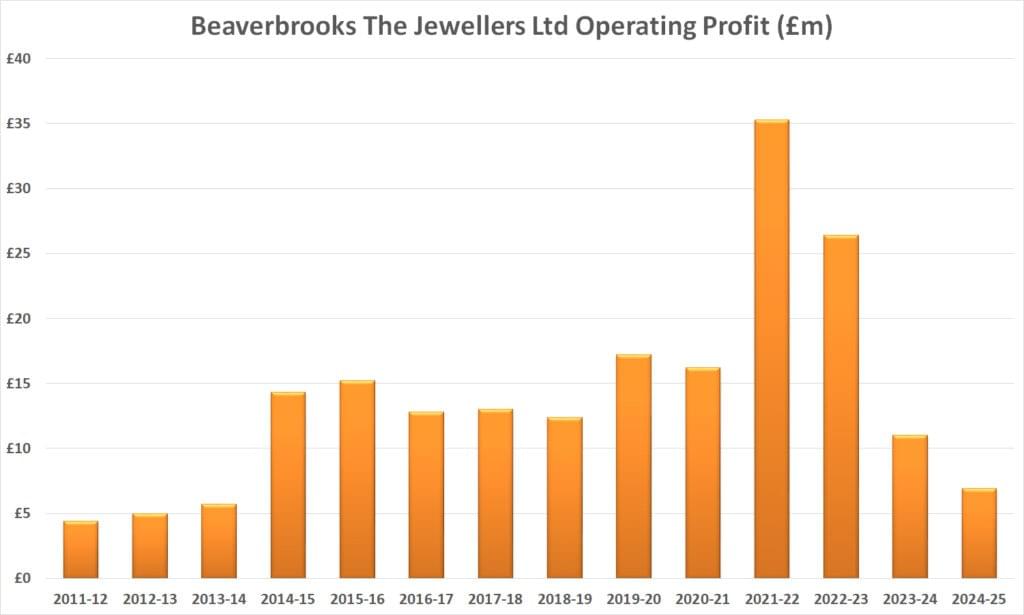

It is the same story at mid-market jeweler Beaverbrooks, which expanded its estate to almost 90 stores during the boom but has since trimmed it to around 80.

Sales hit a record of £229 million in 2023-24 and dropped only 7% last year, but operating profits have dropped from a high of £35 million four years ago to just £7 million.

It should be noted that Beaverbrooks is one of the only retailers to have published its 2024-25 accounts. The continuing drop in profit for the well-run operation suggests jewelers in the same part of the market are likely to post similar declines when their accounts are public.

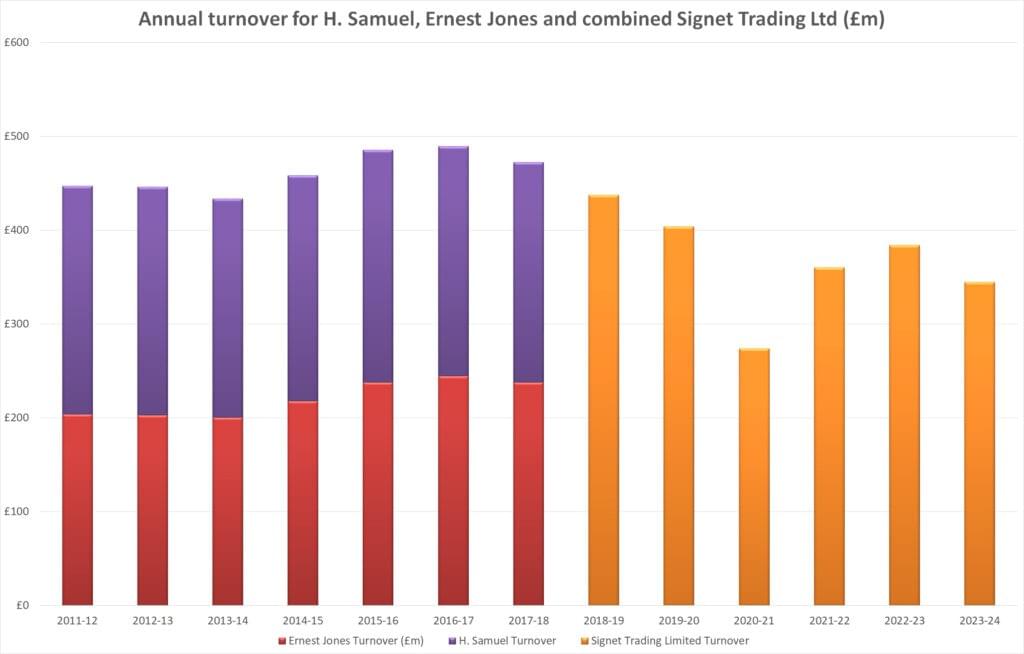

Signet Trading Ltd, the UK-based wing of Signet Jewelers in the United States, has changed some of its accounting policies over the years, which make it harder to track sales and profits.

Today, it groups its upmarket Ernest Jones results in with its volume H. Samuel business in Signet Trading accounts that show turnover steadily declining since peaking at almost £500 million in 2015-16 to £345 million in 2023-24.

During that same period, operating profit dropped from £60 million to a loss of £50 million in 2021-22.

Being a UK subsidiary of an American PLC, the business can structure itself so that profits are banked in the most advantageous way.

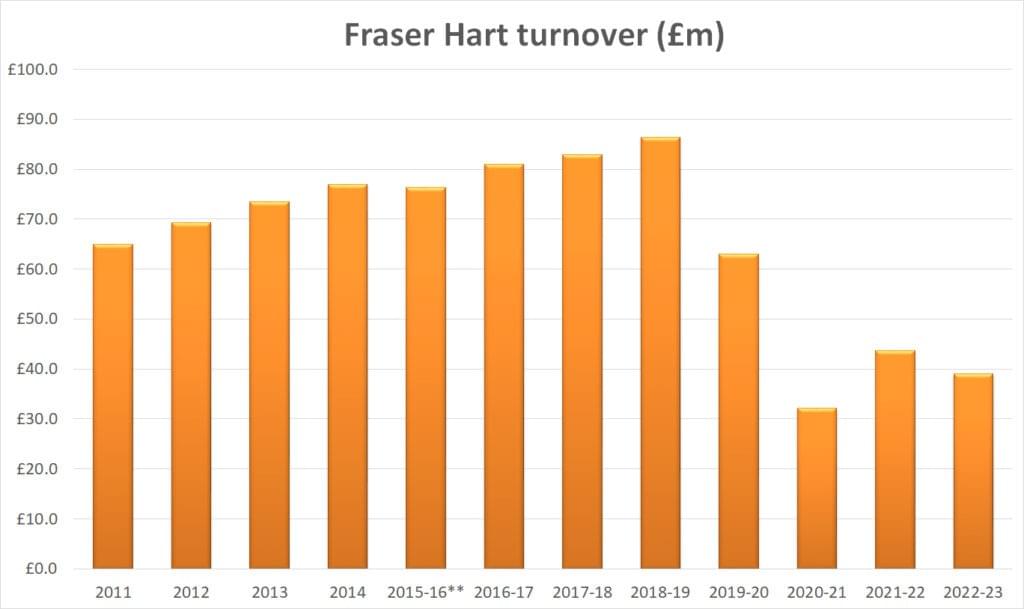

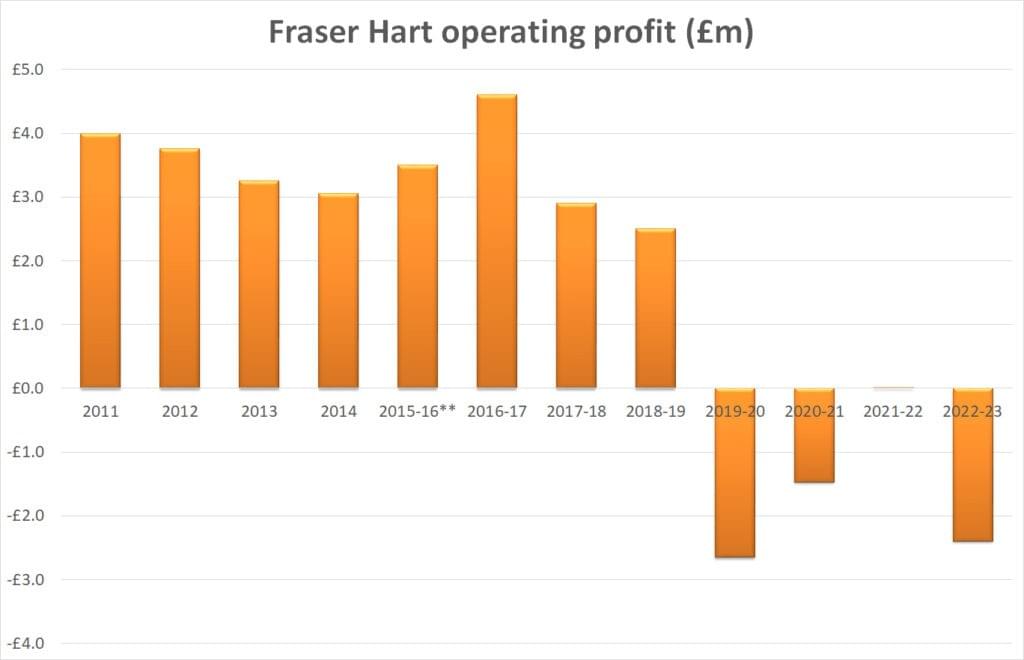

Fraser Hart struggled to bounce back after the pandemic years, and its troubles were exacerbated when its relationship with Rolex came to an end, triggering the sale of several stores.

Turnover has almost halved from £78 million in 2018-19 to under £40 million in its most recent published accounts.

Operating profits went negative in the peak pandemic year of 2019-20 and have never recovered.

Among the volume players, perhaps F Hinds will be most satisfied with its recent performance.

Sales for its affordable watches and mainly silver jewelry have not risen or fallen over the years with the sort of extremes seen by the Rolex retailers, so it did not get caught up in the over-exuberance.

As a result, it banked record profits in 2021-22 as stores reopened after lockdowns and, even though they have fallen back sharply since, the business is still enjoying margins that far exceed those it delivered in the 2010s.

Falling operating profits mean lower corporation taxes for the UK Treasury, which is desperately casting around for ideas that raise taxes without snuffing out growth.

Successive governments have provided some business rate relief for retailers, and was generous with loans and the furlough scheme during the pandemic, but recent years have seen damage to high streets with the imposition of higher taxes for consumers and businesses at a time of a cost of living crisis and the withdrawal of duty free shopping for overseas visitors to the UK.

America faces a different set of challenges, not least the impact of an additional 39% tariff on Swiss watch exports that seems certain to push up prices at a time when customers feel they are already too high.

As in the UK, this will push up customers acquisition costs and weigh on profits, particularly in the volume-to-mid market.