Troubled miner Lucapa Diamond Company has secured a proposed rescue deal from Dubai-based Jemora Group, offering a financial lifeline that could steer the company out of administration.

Administrators KordaMentha confirmed that a deed of company arrangement has been signed with Jemora’s subsidiary, Gaston International, under which the investor will inject approximately A$15 million (US$10 million) into Lucapa. The agreement promises to fully repay creditors while also providing shareholders with a partial payout of up to 1.8 Australian cents per share—an improvement on Lucapa’s last traded price of 1.4 cents before entering administration in May.

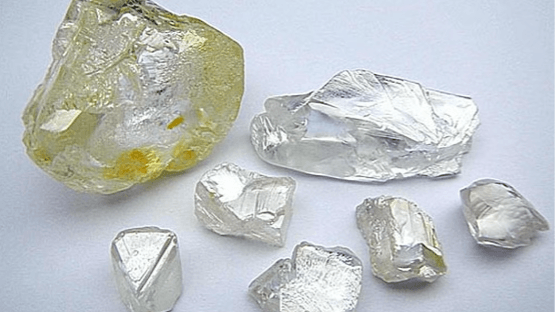

Lucapa, operator of Angola’s Lulo alluvial mine and the Merlin diamond project in Australia, entered administration following a sharp downturn in global diamond prices, growing competition from lab-grown alternatives, and operational setbacks including flooding at Lulo and a February blockade by local leaders.

The company had previously sold its Mothae mine in Lesotho in 2024, leaving Lulo as its sole revenue-generating asset. Attempts to raise equity earlier this year and to sell a 40% stake in Merlin both failed, pushing the company into insolvency by late May.

The proposed deal would restructure Lucapa and transfer majority control to Jemora, a diversified metals and mining conglomerate that is positioning the UAE as an emerging hub for global resource investment.

A meeting of creditors is scheduled for August 20, where the plan will be put to a vote. Court approval would also be required before the deal can proceed.

If successful, the lifeline could mark a critical turnaround for Lucapa, a company that has faced mounting pressure since 2023 amid one of the diamond sector’s toughest cycles in recent years.

✨ Want to explore more exclusive insights into the global diamond & jewelry industry?

👉 Visit aidi.org