The past week brought a rare flurry of mergers and acquisitions in the diamond and jewelry market. These don’t come around often, yet three deals landed within days of each other — spanning miners, jewelers, and luxury brands.

Do they signal renewed investor interest in the trade? Maybe, but let’s not get ahead of ourselves. Each deal had its own context and its own motives.

Lulo’s Allure

Take Lucapa Diamond Company, whose sale was arguably the most significant in terms of investor confidence, given the tough climate for miners. Plenty of diamond companies are currently looking for funding or a buyer — the biggest case, of course, being Anglo American’s plan to exit De Beers.

Lucapa, however, found a buyer in Gaston International DMCC, a subsidiary of Dubai-based Jemora Group led by CEO Dev Shetty. The company holds a 40% controlling share of Angola’s Lulo alluvial mine — famous for its high-value production and steady flow of big stones — plus a 39% stake in the promising Lulo kimberlite exploration project. It also owns 100% of the Merlin mine and 80% of the Brookings exploration program in Australia.

These may be relatively small-scale operations, but the market can still chalk it up as a win. One deal won’t restore broad investor confidence in diamonds, but it might nudge others to take a more positive look at the many assets still sitting on the block.

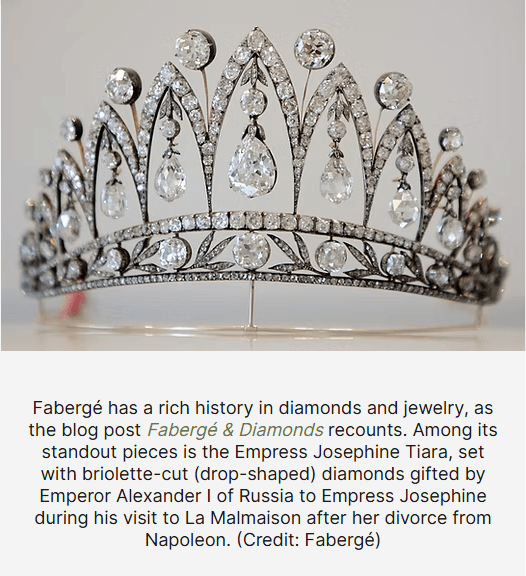

Fabergé’s Fall

Then there’s Gemfields, which sold the Fabergé brand to investment firm SMG Capital for $50 million. The company presented the move as a return to its core strengths — mining rubies in Mozambique and emeralds in Zambia. But it inevitably raises the question: why buy Fabergé in the first place? Back in 2013, Gemfields paid $142 million for the heritage brand, only to see its value shrink by two-thirds in just over a decade.

And Gemfields isn’t alone. Several miners have tried their hand at luxury or retail, but almost none have made it work. Dominion Diamond, former owner of the Ekati mine, never found real synergies with its Harry Winston venture. De Beers has long wrestled with turning its branded retail operations into a profitable business.

The lesson seems clear: mining houses are rarely good custodians of luxury. It’s a different skill set required in a different world. For Gemfields, that mismatch cost 12 years and a hefty write-down. For others still tempted to chase the glamour of the branded luxury market, it should serve as a cautionary tale.

Berkshire’s Bet

The final deal of the week was perhaps the highest-profile and most strategic: Berkshire Hathaway combining Helzberg Diamonds and Ben Bridge Jeweler into a new unit, BH Jewelry Group. As JCK’s Rob Bates noted, the move likely reflects shifts within Berkshire itself, with Greg Abel’s more hands-on leadership style now setting the tone after Warren Buffett’s departure.

That’s not to say there aren’t synergies between the two retailers. There almost certainly are. Combining areas like sourcing and administration should help strengthen the business. Both Helzberg and Ben Bridge are already considered among the better-run operations in the trade, but their consolidation reflects a wider trend: top-tier jewelers looking for ways to trim costs, tighten inventory, and drive efficiency.

If there’s a common thread running through this wave of mergers, it’s this: where diamond and jewelry companies once chased volume and top-line growth, today the focus has shifted squarely to the bottom line. That means finding value in your niche, doubling down on core strengths, and striking smart collaborations to deliver growth where it really matters.

✨ Want to explore more exclusive insights into the global diamond & jewelry industry?

👉 Visit aidi.org