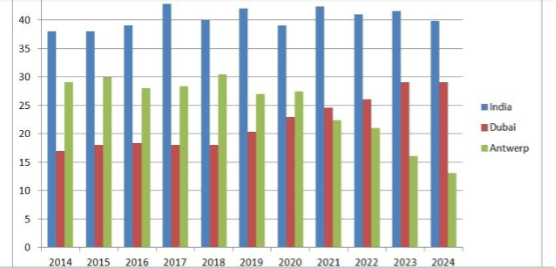

This diagram above shows the dynamics of rough diamond imports (in carats, according to the Kimberley Process) by the three largest hubs over ten years as a percentage of the total market volume. It is not difficult to see that in 2014 - 2018 the picture was stable: fluctuations in the indicators did not reflect any pronounced trends. But from 2019, the situation changed - the flow of rough diamonds to Dubai began to increase rapidly. And from 2020, the volume of rough entering Antwerp began to decrease equally rapidly. Given that the volume coming to India and smaller hubs (Israel, China) remained virtually unchanged, we have to state that the development of Dubai occurred mainly due to the proportional decline of Antwerp. Such cannibalization, evident today, seemed unlikely to many competent industry representatives only a few years ago. «Dubai and India are taking market share away from other countries such as China and Israel, but they are not taking it away from Antwerp» - said AWDC's Karen Rentmeesters in 2020 and argued that Dubai would not be able to overtake Antwerp. But already in 2021 her prediction did not come true - Dubai overtook Antwerp, and in 2024 the gap between these hubs more than doubled. Most likely, this trend will continue in 2025. What are the reasons behind this trend?

Since the establishment of the Dubai Multi Commodity Center (DMCC) in 2002, Dubai has consistently and successfully developed an infrastructure that has made it possible to ensure dynamism and transparency in the diamond trade, as well as largely minimize the costs of customers: from taxes to transportation and insurance costs. The success was greatly facilitated by the favorable geographical location, security, high standard of living of the population, balanced and friendly policy of the UAE leadership towards African diamond producing countries, primarily Angola, which almost entirely sent its diamonds to Dubai, as well as Israel, which led to the conclusion of the Abraham Accords in September 2020. All this contributed to Dubai reaching a stable third position among the world's diamond hubs. It would still be there today were it not for two circumstances.

During the COVID-19 pandemic in 2020 - 2021, many EU countries, and Belgium in particular, were gripped by bureaucratic madness, expressed in countless and often unjustified bans and lockdowns, which had a detrimental effect on many businesses, including the diamond trade. A logical response was the migration of the diamond business to the UAE, where the notorious «anti-COVID» measures were orders of magnitude more lenient. It even got to the point that in the summer of 2021, the Gemological Institute of America (GIA) closed its laboratory in Antwerp and announced its move to Dubai. It was as a result of the business reaction to the outrages of the «anti-COVIDians» that in 2021 the flow of rough diamonds to Dubai surpassed that to Antwerp for the first time in history. This was a strong but, alas, not the last blow of the European bureaucracy to the Antwerp diamond hub.

The second, and incomparably stronger blow followed in 2022 in the form of anti-Russian diamond sanctions. It was clear to any sensible specialist in the industry from the very beginning that these sanctions were a meaningless and dangerous idea for the market. The profit received by ALROSA and AGD from diamond exports barely exceeded one percent (!) of Russia's defense budget and a priori could not have the slightest impact on the course of the Russian-Ukrainian conflict. But at the same time, Russian diamonds accounted for about 30% of the world production, and declaring them «bloody», «illegitimate», «unethical» led both to an erosion of consumer confidence in diamond products in general and to a radical drop in prices, since there was no doubt that dumping and «black» trade schemes would be used to promote sanctioned products. Nevertheless, industry institutions and Antwerp World Diamond Center (AWDC), among others, enthusiastically supported this disastrous initiative for the diamond market. The result did not slow down - now Antwerp does not receive even half of the «pre-sanctioned» amount of diamonds. But they are coming to Dubai, because the DMCC management has enough professionalism and common sense to adequately assess the anti-Russian diamond sanctions as the work of politicians who have nothing to do with the diamond business.

Thus, the epic rise of Dubai and the dismal decline of Antwerp once again confirmed the textbook truth - the less politics and bureaucracy meddle in business, the healthier the business feels and the more successful it develops. And as long as the tax and regulatory policy was based on this thesis, Dubai had every chance not only to strengthen its position in the rough diamond sector, but also to make significant progress in the polished diamond sector.

Unfortunately, as of late, trends have begun to emerge that are significantly hindering Dubai's development as a diamond and polished hub. In 2023, a corporate tax with a rate of 9% was introduced for taxable income exceeding only 375,000 UAE dirhams ($102,097). Prior to the introduction of this measure, Dubai's tax regime (with a zero corporate tax rate) was far preferable for diamantaires to Antwerp's tax regime, which involves paying a fixed percentage of turnover. Antwerp's tax advantages also include a zero VAT rate on transactions with uncut diamonds, while in Dubai it is 5%. And although in January 2025 the UAE Cabinet of Ministers decided to reverse withholding VAT on polished diamonds, the practice of its implementation leaves much to be desired due to bureaucratic delays.

Dubai's competitiveness is also reduced by too high operating costs, as well as customs and transportation fees, which exceed Belgian ones by at least a third. Another negative factor, the impact of which is constantly growing, is the tightening of bank compliance and administrative regulation, which turns the noble task of combating money laundering into a bureaucratic quest for businesses. In fact, any diamond transaction of just 55,000 dirhams ($14,974) or more falls under the full disclosure requirement. A very ambiguous contribution to the investment climate in Dubai is made by the activities of numerous consulting companies that manage to simultaneously advise UAE government institutions on the introduction of new taxes and levies and simultaneously advise business structures on avoiding these taxes. Such impressive earnings from conflicts of interest and the accompanying administrative chaos are uncharacteristic of Belgium.

It is worth noting that at one time the same global consultant promised both De Beers and Alrosa that a golden age was coming and there would be nowhere to put the money.

The problem with «best practices» is that they often turn into a business themselves, parasitizing the mainstream. The problem with administrative mechanisms is their inertia. It is not easy to implement them, but even more difficult to abolish them. Now it is ridiculous to say that the WTO and international arbitration exist. But exists nonetheless.

Sergey Goryainov is an independent journalist, who writes on topics related to the diamond industry. He is an author of several books and over 200 publications in specialized press. From 2000 to 2006, he was a member of the ALROSA Information Policy Council. Sergey is currently working on a book about the operations of the Third Reich and Stalin's USSR in the diamond market. This article reflects solely his personal opinion.