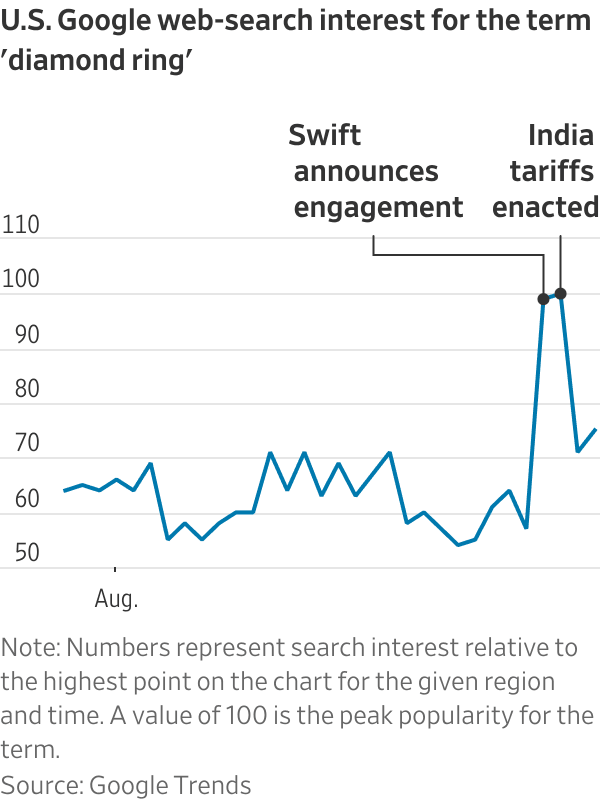

Two consequential things happened for the diamond-jewelry industry this past week: Taylor Swift got engaged, and America placed 50% tariffs on the country that exports most of those stones.

Diamond-jewelry retailers Signet Jewelers and Brilliant Earth saw their stock prices rise 3% and 26%, respectively, on Tuesday, the day Swift announced her engagement with football star Travis Kelce, posting a picture of her diamond ring. Their shares rose again—by 6.3% and 2.5%—on Wednesday, when America’s punishingly high tariffs on India took effect. India cuts and polishes most of the world’s diamonds, while America is the largest consumer of diamond jewelry.

Could it be that Swiftonomics is overshadowing bad tariff news? Possibly. Google searches for “diamond ring” surged after the announcement. But a tariff-induced boost in pricing might actually not be such a bad thing for the natural diamond industry, if it helps differentiate them more from the ever-depreciating lab-grown variety by underscoring their value and scarcity.

The tariffs on India could be affected by a federal appeals court ruling late Friday that struck down “Liberation Day” tariffs on trading-partner countries. But the ruling allowed the tariffs to remain in place through mid-October to allow the parties to ask the Supreme Court to hear the case.

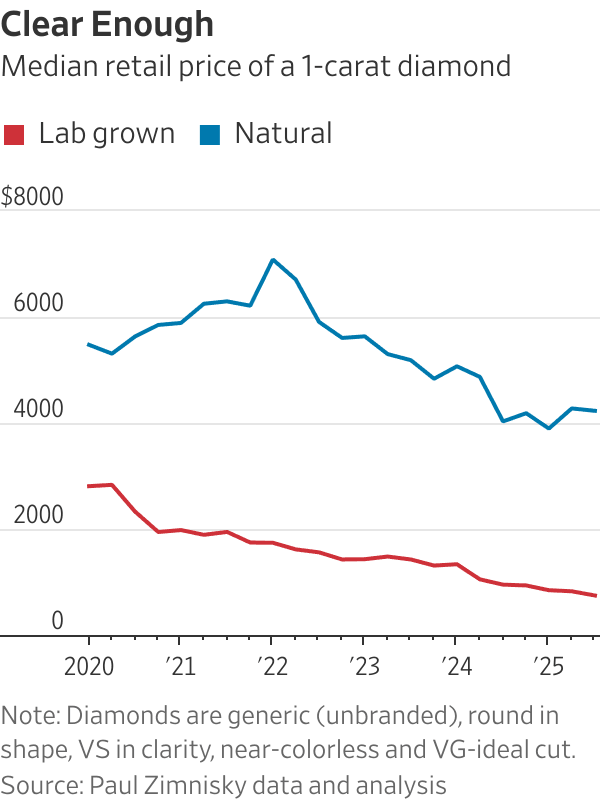

Natural diamonds have been stuck in a bad cycle over the past few years: Margins on lab-grown diamond jewelry have been so high that retailers have been tempted to sell bigger, cheaper synthetic stones over the natural variety. This has eaten away at the market share and prestige of natural diamonds. Retailers’ gross margins on lab-grown diamonds are around 71%, compared with around 33% for the real thing, according to diamond industry analyst Edahn Golan.

Tariffs might actually pressure retailers to stop presenting lab-grown diamonds to consumers as an interchangeable product with natural ones, according to Paul Zimnisky, a diamond industry analyst. “If you’re in the natural business, you can’t compete with lab-grown on price,” he said in an email. “One is a rare gemstone, the other is a manufactured product that can be produced in unlimited quantities.”

Plus, the sticker shock to consumers might be more muted than it looks because the tariff applies to the wholesale price rather than the retail price, according to Zimnisky. So far, retail prices of natural diamonds are up 8% to 10% after news of the 50% tariffs broke, compared with where they were when the threatened tariffs were only 10%, he noted.

Tariffs also apply to lab-grown diamonds because India is one of the top producers of those as well. But wholesale prices on those are very low to begin with, and the cost of producing them keeps coming down, so the impact won’t be that consequential. In fact, Zimnisky notes that lab-grown diamond prices are down since the tariffs were announced. They might have declined even more without tariffs.

Retailers can probably navigate budget-sensitive customers too. Shoppers typically have a budget in mind when they shop for diamond jewelry, Golan noted. But diamonds come in such different sizes and quality—think color, clarity and cut—that they can probably shift customers down to a size and quality that works for their budget, he added.

Most jewelers now sell both the natural and man-made kind, which gives them flexibility. About a fifth of the diamond jewelry that Signet Jewelers sells is lab-grown, for example. Investors will get further details on the impact of tariffs when Signet reports earnings on Tuesday.

Signet’s and Brilliant Earth’s stocks have underperformed the market over the past two years on tepid jewelry sales. Signet’s comparable-store sales have declined over its past three fiscal years; the smaller Brilliant Earth saw weak sales growth in 2023, followed by a decline last year.

Ultimately, demand for diamonds is psychological. The twin jolts of Swift’s engagement and tariff-induced scarcity could be just what is needed to take the tarnish off natural diamonds in the minds of consumers. Investors are right to be celebrating.