Jewelry has long symbolized personal meaning, heritage and timeless beauty. Today, amid rising trade tensions and new tariff enforcement, it also reflects global economic policy. Behind the joy of a diamond engagement ring or the elegance of a gold chain lies a complex web of cross-border trade, material sourcing and political influence—one that’s now facing an unprecedented shake-up. During recent jewelry trade shows in Las Vegas, I spoke with designers, brand leaders and international executives. All acknowledged the same truth: tariffs are changing the game. Quietly so far, but significantly.

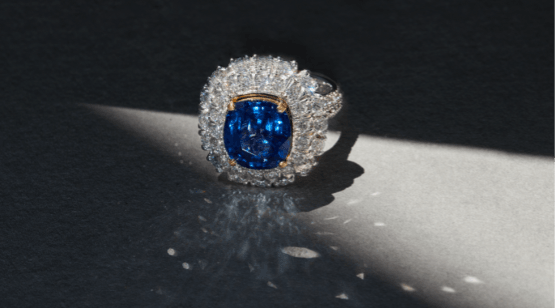

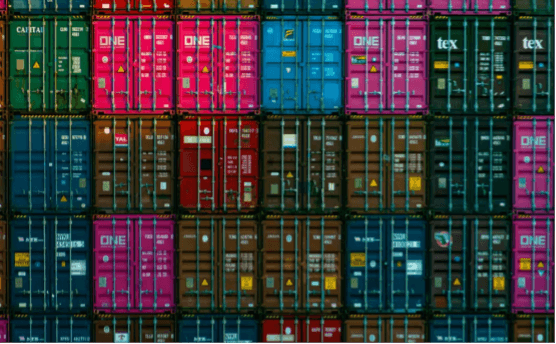

Most consumers don’t realize just how complex international jewelry really is. A single piece may include a Sri Lankan sapphire, cut in Bangkok, set in India and sold in New York. That journey matters, especially under U.S. trade law. According to U.S. Customs, a product’s country of origin is determined by the concept of “substantial transformation.”

As defined by the International Trade Administration: “Substantial transformation means that the good underwent a fundamental change in form, appearance, nature or character. This fundamental change normally occurs as a result of processing or manufacturing in the country claiming origin. Additionally, this change adds to the good’s value at an amount or percentage that is significant, compared to the value which the good (or its components or materials) had when exported from the country where it was first made or grown.”

This legal origin determines whether import tariffs apply. Those tariffs can drastically impact price, margin, and production strategy for industries like jewelry, where materials and craftsmanship are sourced globally.

With every new tariff announcement, one thing is almost guaranteed: the price of gold surges. Historically seen as a safe-haven investment, gold becomes even more attractive in times of market volatility. This has consequences for the jewelry industry, especially when paired with rising labor and shipping costs.

For designer Lisa Nikfarjam of Lisa Nik, the effects have been significant. “The ripple effect caused a triple whammy: Tariff + Gold Price + Exchange Rate,” she said during the Couture Show. “Even with a 10 percent tariff, when combined with record-high gold prices and unfavorable currency exchange rates, the cost of producing a gold item jumped 40 to 45 percent almost overnight.”

Some suppliers rushed to ship ahead of the new enforcement. Others didn’t. “We were left with an increased cost added to existing orders that had already been sold at a certain price,” Nik said. Rather than compromising quality or creativity, she has focused on tight inventory management, domestic production and transparent client communications.

Lisa Koenigsberg, president of Initiatives in Art and Culture, who founded the annual Gold and Diamond Conference, echoed these concerns from a broader perspective. “There is an atmosphere of deep concern in the jewelry industry, which is considering what actions to take in the face of constantly changing signals regarding tariffs, including measures that the average consumer is likely unaware of,” she noted. “Some consumers are already feeling the pain of increased prices that were raised even as early as June in anticipation of heightened tariffs to be imposed on the now Aug 1 deadline.”

Koenigsberg added that while luxury brands catering to the highest-end clientele may weather price hikes more easily, a broad swathe of fine and fashion jewelry could see delayed purchases and reduced accessibility. “The experience for the average consumer will be negatively impacted, with the repercussions being felt throughout the industry which ultimately sets the prices.”

Sara Yood, president, CEO and general counsel at the Jewelers Vigilance Committee (JVC), explained how this legal burden is shouldered domestically. “Tariffs are paid by the U.S. importer, not the foreign business that exported the goods or the countries from where the goods were exported,” she noted. “Even a 10 percent tariff on foreign goods adds up extremely quickly at the value scale of jewelry.”

For everyday buyers, this can mean higher prices or fewer options in stores as businesses recalibrate. “Virtually all of the components that go into jewelry—precious metal, diamonds and colored gemstones—originate outside the U.S. Finished jewelry and watches will also face a duty upon import,” Yood added. “That means you may see pricing increases or changes in assortment as businesses adjust to this new paradigm.”

Luxury in a time of adjustment

According to Bain & Company’s July 2025 report, the personal luxury goods market is expected to grow between just 1 and 4 percent this year, following two years of double-digit growth. The slowdown has hit the U.S. and European markets hardest, with consumers demonstrating more cautious, selective purchasing behavior in response to economic pressures. However, the fundamentals of the luxury industry remain strong, with younger consumers and high-net-worth individuals still contributing to long-term growth. Jewelry, a category known for its emotional and investment value, continues to stand resilient, even if cautiously so.

This economic tension is echoed in broader retail trends. According to the National Retail Federation’s July 2025 Monthly Economic Review, inflation remains a top concern for both retailers and consumers. Although inflation rates have eased compared to last year, pricing pressure persists due to continued supply chain volatility, fluctuating commodity prices and global instability. The NRF notes that consumer spending is still strong, but increasingly selective. Shoppers are focusing more on essentials and delaying discretionary purchases. For the jewelry industry, this means that while the desire for beauty and significance remains, price sensitivity plays a bigger role in when and how people buy.

Vin Kothari, president of Precious Colors Inc., shared that while tariffs have created uncertainty, his company sees this moment as an opportunity to double down on domestic trust. “The tariffs have been an ongoing concern for our business; the uncertainty has impacted our customers’ sentiments as there is no clarity on how to proceed,” he said during the AGTA GemFair at the JCK Show in Las Vegas.

“Regardless, we always maintain a long-term and optimistic view in our organization. We also realize that the tariffs could provide us with a great opportunity to remain a leading source of fine gemstones and jewelry in the U.S., as our customers look to buy more domestically.”

He emphasized that while costs have increased, the company has deliberately chosen not to pass those costs directly to customers. “There is already a lot of sticker shock due to rising gemstone prices,” Kothari noted. “As a manufacturer with vertical integration capabilities, we continue to absorb the pricing impact ourselves as opposed to charging our customers more. We don’t want to compromise our customers’ loyalties.”

A personal reflection on value and luxury

As a gemologist and jewelry professional, I understand the instinct to pause before making luxury purchases in uncertain times. Yet if I’m going to spend, I want that money to hold meaning and value. Gold is not just adornment. It is security. If I’m going to invest in something during a volatile economy, I’d rather it be something wearable that brings me joy and holds intrinsic worth. That said, not everyone can afford to make these choices. With rising living costs, many families are weighing what to buy now and what to hold back on. For special occasions or meaningful milestones, jewelry remains, in my opinion, a practical luxury—one that can last generations. I’m still betting on the jewelry industry, both emotionally and economically. Yet each household will need to make its own choices. Luxury may still be part of our lives, but perhaps more carefully considered.

Rooted in trust and shaped by time

Lynn Phyo, general manager of B.P. De Silva Jewellers, shared that uncertainty has tested the brand’s relationships with U.S. retail partners. “The learning curve has been steep. Understandably, U.S. partners have been cautious when working with overseas brands until there’s more predictability,” she noted at Couture. Their response has been rooted in reassurance. “Our business is built on strong partnerships, and this will be one of those defining times,” she explained. “We’re on a fact-finding mission and showing how we’ll get through this together.” With complete control of the brand’s design, sourcing and manufacturing in-house, B.P. De Silva has held its pricing steady. “We continue to pass value directly to our clients,” Phyo added. “As our founder said, ‘We must be able to price it at the value we are willing to pay ourselves.’ That still holds true, 153 years later.”

Adaptation without compromise

At Goshwara, founder and designer Sweta Jain adjusted quickly. “We introduced hollow chains in response to the increased cost of gold,” she shared, “but we’ve continued offering solid chains for those who request them.”

Despite challenges, Jain reported one of the brand’s strongest shows ever, with a surge in demand for pink opals, malachite and bold inlay work. “We’re serving two types of customers,” she observed. “One looking for something trendy and bold, the other drawn to timeless, refined pieces. Luckily, we’ve found success balancing both.”

Meanwhile, Laura Gallon, of Laura Gallon Joaillerie, has leaned on her dual production model to weather the storm. “U.S. orders are fulfilled through our American workshop, while European orders go to France. It helps control costs and delivery times,” she explained. “We’re holding pricing steady for now, but we’re prepared to adapt if needed.” For Andreas Bentele of Fortis, the iconic Swiss watchmaker, tariff pressures are real, but quality remains non-negotiable. “Tariffs affect our U.S. pricing, but we will never let trade policy dictate our craftsmanship,” he said. “We’re adjusting strategy carefully, focusing on sustainability and long-term customer value.”

Jewelry in a time of transition

Jewelry is more than just decoration. It is a form of storytelling, craftsmanship, investment and memory. In 2025, it is also a mirror reflecting the state of global trade and shifting values. With tariffs rising and gold prices climbing, brands are under pressure, but so far, they’ve responded with resilience, transparency and creativity.

As a jewelry shopper, you may notice price changes or differences in what designs are available in stores. You’re not imagining it. The ripple effect of tariffs, rising material costs and international logistics challenges is real, and it trickles down to the final price tag. That doesn’t mean you should stop shopping, but it does mean you should shop smarter. Start by asking questions. Where was this piece made? Are the materials ethically sourced? Is the gold recycled or newly mined? Does the brand manufacture domestically or abroad?

Even something as simple as reading a brand’s “About” page or asking for third-party certification can help you make a more informed, potentially more meaningful, purchase. The best jewelry companies welcome these questions because they take pride in their sourcing, artistry and values that guide their work. If you’re planning a milestone purchase, whether an engagement ring, future heirloom bracelet or everyday necklace, consider buying sooner rather than later. As Sara Yood of the Jewelers Vigilance Committee noted, tariff rates may rise again, and delays in global trade can create bottlenecks. Acting now may not only save you money, but also ensure that you secure a piece you truly love.

Remember, jewelry has been a long-term investment for generations. Unlike fast fashion, a thoughtfully chosen piece can last for generations. The goal isn’t to buy more. It is to buy better. So, if you’re going to spend, then spend where it counts. Choose pieces that reflect your values, your story and your hopes for the future. Jewelry may be facing a time of economic uncertainty, but it remains, now more than ever, one of the most personal, enduring and expressive purchases you can make.