Signet Jewelers is emerging as the ultimate test case of how the natural and lab-grown diamond segments are evolving.

As the industry bifurcates between natural diamonds as a value play and synthetics as a volume driver, Signet reflects that split, with bridal anchoring the natural side and fashion leaning into lab-grown. The divide will only become clearer as the company pushes ahead with its “Grow, Brand, Love” strategy, unveiled by CEO J.K. Symancyk in March, and rolled out more fully in the coming years.

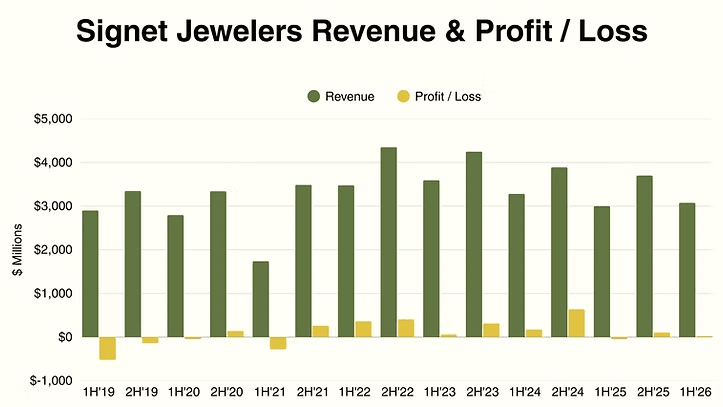

It would be premature to credit the program for Signet’s upbeat interim earnings last week, which showed a swing to profit and signs of a sales recovery.

For now, Symancyk can take some satisfaction in having proved his doubters wrong in a relatively short time. Just six months ago, shareholders were calling for a strategic review and possible sale of the company, while questioning his appointment.

They pointed to the share price, which in February had shed 50% of its value in just three months following 11 consecutive quarterly declines in same-store sales that culminated in a disappointing holiday season.

The stock has since regained that lost ground under Symancyk, after he delivered positive same-store growth in two quarters, with the latest results beating expectations. For the half year to August 2, 2025, both revenue and profit improved.

Back to Black

Group sales rose 2.5% year on year to $3.08 billion for the period, with same-store sales up 2.2%. The company swung to a $24.4 million profit from a $46.4 million loss a year earlier. The share is up about 6% from its pre-earnings level, opening Monday at 93.65.

Based on Signet reports by Signet Jewelers, until the fiscal half year that ended August 2.

The performance validates “Grow, Brand, Love” to some extent, not least by building confidence that Symancyk and his fresh-looking management team can deliver in the medium to long term, as they have in the short term. That they did so while the jewelry market faced immense volatility — with new US tariffs, geopolitical turmoil, and consumer uncertainty — makes the results all the more notable.

Continuing the momentum will depend partly on a stabilization of those macro forces, as Symancyk noted on the September 2 earnings call. But more importantly, it will hinge on how the new strategy is implemented, how it plays to the respective strengths of natural and lab-grown diamonds, and how the interplay between the two — or more precisely, their separation — shapes the company’s growth path.

Inside the Strategy

To recap, the “Grow, Brand, Love” program sets out three priorities.

Video explaining the strategy when it was first released.

First, Signet wants to think more like a branded company. That means modernizing and giving each of its banners — now referred to as brands, especially Kay, Zales, Jared, and Diamonds Direct — sharper distinction. It is also emphasizing fashion jewelry and building stronger emotion into its messaging. At the same time, it aims for design and trends to drive innovation, while capitalizing on its digital presence to refine the omni-channel experience.

Second, the company plans to push deeper into fashion jewelry while keeping bridal at its core. And finally, Signet is reshaping its operations — trimming the portfolio, cutting costs, and closing stores — to build a leaner, more efficient business.

A closer look at the latest earnings suggests Signet still has work to do in its strategy to elevate its flagship fashion and bridal channels.

Where Growth Lies

In the first half, growth came mainly from smaller segments: watch sales rose 11% to $150 million, services gained 5% to $384 million, and “other” businesses — diamond sourcing and non-jewelry — jumped 20% to $84 million. By contrast, fashion jewelry edged up 1.1% to $1.09 billion, and bridal increased 1% to $1.37 billion.

That highlights the core challenge for Signet: how to generate meaningful growth off such a large sales base.

Its answer for bridal is to double down on natural diamonds, relying on their higher value to drive growth. The average sales price, or average unit retail (AUR), rose 4% year on year in the second quarter — the third straight quarter of AUR growth — while transaction volumes held flat.

Signet sees opportunity in the $2,000 to $5,000 “sweet spot,” CFO Joan Hilson noted, “particularly as we see the stabilization and even the increase in natural diamond pricing.”

Signet’s fashion sales were also lifted by higher average prices, with AUR up 12% while units sold fell 7%. Higher gold prices played a role, but the bigger driver was lab-grown diamond jewelry, which now makes up 14% of the category and carries an AUR more than three times that of other fashion pieces, Hilson noted.

That context matters given that volume in fashion is still partly driven by Banter by Piercing Pagoda, where the average unit is priced below $200. Sales there slipped 2% to $158 million in the half year.

Symancyk, however, emphasized a different focus within fashion: “we are significantly bolstering our lab-grown diamond, men’s, and other trending category assortments in the key gifting price points of $200 to $500, as well as higher penetration in lab-grown diamond fashion across all price points.”

In line with that, the company expects the number of lab-grown fashion pieces priced below $1,000 to be at least three times higher than last year, with even stronger growth below $500, he added.

The bottom line is that lab-grown lifts the group’s fashion assortment into a much higher price bracket.

Market Split

The net effect of these price trends in both bridal and fashion was that overall merchandise AUR for the first half rose 9.8% in North America and 5.8% in Signet’s international business.

That runs counter to the narrative that rising lab-grown sales are pulling down average ticket values. Signet may be avoiding that pressure by positioning lab grown as a substitute for other fashion categories, rather than as a replacement for natural.

But one can’t help but wonder about the opportunity cost, since every lab-grown diamond sold today still represents a natural diamond not sold. That equation may shift as the market matures and as Signet refines its offer, with the ‘Grow, Brand, Love’ strategy seemingly aimed at fully separating the two into distinct businesses.

The company’s interim results may mark the early stages of Signet’s bridal–natural and fashion–synthetic alignment. While that divide is gaining momentum across the jewelry industry, the next phase of Signet’s strategy will show how fully it can be realized. It will also indicate whether Signet is simply reflecting the market’s direction or positioning itself as the industry leader in driving it.