Sarine Technologies’ revenue fell in the first half of the year amid weak rough demand, primarily in China, and the rising popularity of lab-grown.

Overall sales declined 30% year on year to $15.3 million for the six months that ended June 30, the Israel-based producer of technology for the diamond industry reported Monday. The slowdown in demand for natural diamonds has caused manufacturers to delay or defer the purchase of capital equipment, the company noted. Recurring revenues — from fees clients pay when they use Sarine systems, such as its Galaxy rough scanners — also declined due to the downturn, it explained.

Revenue in India — the company’s largest market — decreased 32% year on year to $7.6 million, and in Africa, fell 25% to $2.3 million. Sales in the US slid 19% to $2 million.

Meanwhile, the company reported a loss of $166,000 for the January-to-June period, compared to a profit of $1 million a year earlier.

Sarine believes additional recurring revenues from new strategic initiatives it implemented in the past year will help stabilize revenue. Those include its expansion of its Most Valuable Plan (MVP) to cover larger stones, and its adaptation of its rough-planning technology to lab-grown. The company’s opening of a new GCAL by Sarine lab in India and the relocation of its manufacturing operations to the country will also lower overall costs, Sarine said.

The technology provider has also advanced its potential acquisition of Kitov.ai. Under the preliminary deal, Sarine will invest $4.1 million for a 33% stake. It will also provide an additional $2.6 million as a convertible loan, which it can activate under certain conditions between February 2027 and February 2028, to up its share to a majority 51%.

However, Sarine is worried about the potential impact of US tariffs on business, especially as India has been the hardest hit.

“For the rest of 2025, we expect demand for natural diamonds to remain at around current levels, though US tariffs, currently set at 50% on Indian exports, may have a destabilizing effect,” Sarine added. “The uncertainty surrounding the tariffs has resulted in delayed ordering by major US retailers ahead of the all-important end-of-year season.”

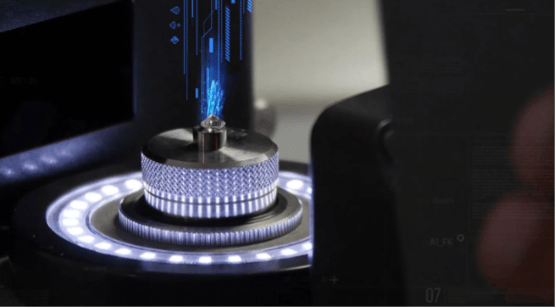

Image: The Sarine DiaExpert data machine. (Sarine Technologies)

✨ Want to explore more exclusive insights into the global diamond & jewelry industry? Visit 👉 aidi.org