Despite production setbacks, sales remain steady — thanks in part to live-stream selling and fashion-forward styling trends.

It only takes a brief dip into jewelry archives to understand the role pearls have played in history. Pearls were, after all, the gem of choice for international nobility, and to some degree, they still are.

“Michelle Obama, the Clintons, all these women, they usually tend to wear pearl necklaces,” says jewelry designer Melanie Georgacopoulos.

Now, the role of pearls has changed. While some dismissed them as outdated a decade ago, strands of these classics are appearing on male celebrities like actor Dave Bautista and Formula 1 champion Lewis Hamilton, and younger generations are turning to contemporary pearl designs for their fine-jewelry fix.

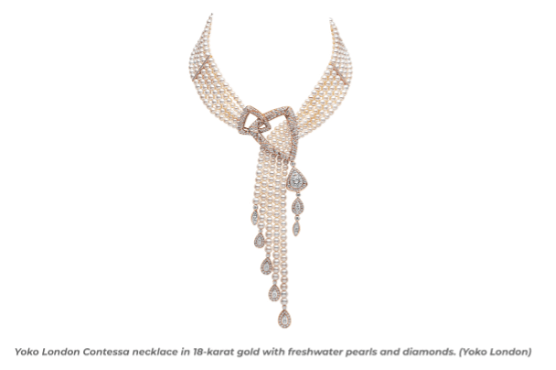

“Pearl jewelry is truly having a global moment,” affirms Michael Hakimian, CEO of pearl-focused brand Yoko London. “We’re seeing strong and consistent demand across all major luxury regions, including North America, Asia and the Middle East, with each region embracing pearls in a distinct yet contemporary way.”

A burgeoning market

Like other sectors of the jewelry industry, the pearl market has proven resilient in spite of volatile times, which have included the Covid-19 pandemic, the introduction of lab-grown gemstones, rising gold prices, and US President Donald Trump’s tariffs.

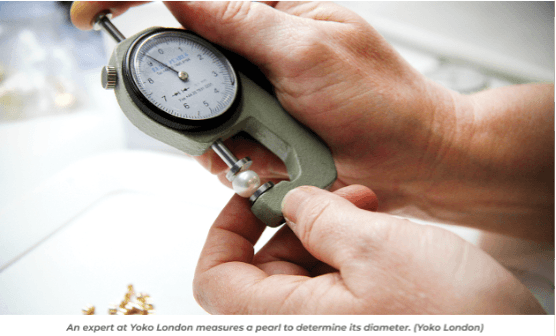

“We’ve seen a significant increase in the cost of pearls,” says Hakimian. “In some categories, prices have risen by as much as 100% over the last three years.”

Nonetheless, “sales have held steady,” according to Jennifer McCurry, buyer and lead fine-jewelry curator at Florida-based retailer Marissa Collections. She attributes the rising prices to “reduced production in Japan and increasing demand from China.”

Japan’s limited akoya production is due to changing environmental factors, such as outbreaks of birnavirus ravaging the oysters, explains Jeremy Shepherd, founder and CEO of Los Angeles-based dealer Pearl Paradise and educational resource Pearl Guide. He says some farms have lost 70% to 80% of their shells.

As for demand, “the biggest market right now, bar none, is China,” he confirms. “The popularity of pearls has surged in the last few years, [and] the vast majority of the world’s production now goes to China.”

China’s interest in pearls has less to do with the country’s proximity to Japan, and more to do with local tastes — and the techniques that Chinese sellers are using to push these volumes. The biggest pearl market in Xian Sha Hu — a town known for its pearl industry — has around 2,400 different vendor booths, but Shepherd discovered on a recent trip that they were mostly empty. The reason? The merchants were selling by live stream instead. This digital tactic is facilitating around two-thirds of China’s pearl sales, according to news reports from the country.

Evolving designs

“The current popularity of pearls is primarily aesthetic,” says Sophia Macris, creative director at jeweler Verragio. “There’s a softness and mooniness to pearls, plus the vintage connotations.”

And it’s not just the pearls themselves. “Pearls have always held their place as a timeless classic, but what’s changed is the way they’re being styled and perceived,” says Hakimian. “There’s been a noticeable evolution toward more fashion-forward interpretations.”

Georgacopoulos attributes this development to the visibility of pearls in mainstream fashion. “When I look at fashion catwalk shows, there’s Simone Rocha using a lot of pearls. You sometimes see Givenchy or Alexander McQueen. It’s so much more out there in terms of imagery.”

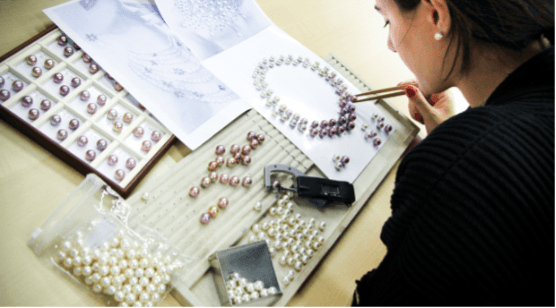

These and other fresh designs are targeting a new generation of tastemakers striving to show their personalities through jewelry. “We’ve seen particular success with pieces that highlight [fine akoya] pearls in contemporary silhouettes,” reports Hakimian. “Our akoya choker styles and layered necklaces have performed especially well.”

While brands selling at higher price points might not be catering to Gen Z, Georgacopoulos says her clients who already have classic items in their collections are now looking for something more individual.

Eco-friendly farming

Pearls lend themselves to the modern-day consumer for reasons that go beyond taste: They appeal to the conscience as well.

“The pearl is the only sustainable gemstone out there — simple as that,” declares Georgacopoulos.

“You’ve got diamonds kind of losing their luster — the lab-grown diamond is just destroying things,” comments Shepherd. “[The diamond industry has] already had difficult times with reputational issues, and pearls are sort of the opposite.”

Pearls “participate in cleaning the water, because they’re filter feeders,” adds Kira Høg Kampmann, founder of pearl specialist Marc’Harit. And unlike diamonds, pearls can be farmed and grown within a year, with the farmers having a direct hand in ensuring safe and sustainable environments.

“All pearl farmers are striving to get high quality, because the higher the quality, the higher the price,” explains Kampmann. “The more they care for nature, the higher the chances of having high quality, and the higher the benefit for the pearl farmer.”

Keeping the pearl sector sustainable comes with challenges. Pearls thrive in remote places because they need what Georgacopoulos calls “quiet waters.” Small farmers in such remote places need to become adept in sustainable farming techniques if they want to produce the high-value specimens that will make it worth their while.

Larger producers such as Jewelmer in the Philippines and Paspaley in Australia are at the forefront of developing these techniques, says Shepherd. “They’re not just following [existing rules], but they’re creating…and leading the standards, and that speaks to today’s [eco-conscious] consumer.”

Kampmann, who has spent considerable time with farmers across the world, hopes to see more traceable pearls in the coming years. One way to guarantee traceability is to purchase directly from the farmers. However, she points out, goods from Japan and China are currently “being bought up by facilities where they have to be processed before they’re sold, and then the pearls are mixed, and we don’t have the traceability anymore.”

Weathering the tariffs

While the recent US tariff announcements may have sparked chaos in many trades, the pearl industry has yet to erupt into panic.

“Though we make our jewelry in the US, we source our pearls from Asia, primarily Japan and China, so we are watching the tariff situation closely and hoping we can avoid price volatility,” says Verragio’s Macris.

Shepherd, in fact, says it has been great for his business. “The entire direct-to-consumer e-commerce space in China just got shut down,” he explains. Thousands of Chinese Etsy and eBay sellers that had been masking as US-based businesses stopped trading due to the expense of shipping from their actual locations, and customers began turning to real US-based companies like his instead. As a result, his $100 to $300 sales have “exploded,” he says.

At Marissa Collections, McCurry has “noticed a growing interest in repurposing. Many of our clients already own pearls and are looking for ways to wear them with a modern edge.”

Hakimian, too, is seeing pearls “not just being rediscovered, but redefined, moving beyond traditional associations.” In the past two years, his clients have shown an interest in finer pearls — particularly akoyas — which he attributes to a heightened interest in craftsmanship.

This redefinition of a gem that was once old news is the gift that will keep giving as the pearl industry heads into the future.

Main image: Melanie Georgacopoulos Vertical Cube pendant in 18-karat yellow gold with golden mother-of-pearl and an 11-millimeter white freshwater pearl. (Melanie Georgacopoulos)