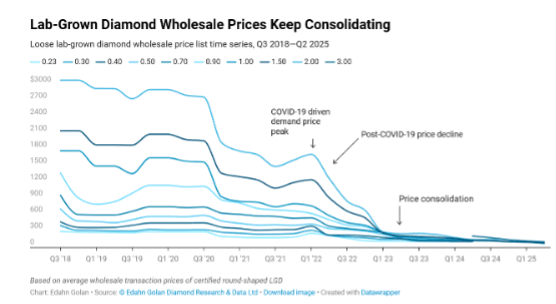

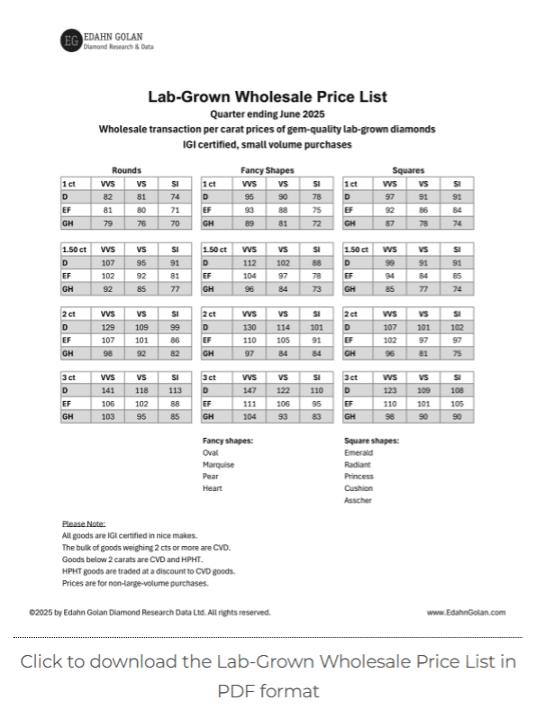

In the second quarter, wholesale trading prices of lab-grown diamonds kept declining. According to our Q2 2025 Lab-Grown Diamond Wholesale Price List (link below), quarter on quarter, lab-grown diamond wholesale prices were down 6.7% overall.

Year on year, prices crashed, as goods in the popular 1–3 carat range fell 42% compared with the second quarter of 2024. Prices were dragged downward by 3-carat rounds, whose wholesale price was slashed in half in the past year.

Although lab diamond wholesale prices continued to decline, the rate did slow from the double-digits of the last few quarters. Here’s why:

Lab-Grown Diamond Wholesale Price Trends

There are few new trends in lab-grown diamond wholesale pricing; mainly existing trends have prevailed. Wholesale prices have been falling continuously with few interruptions since mid-2021. However, this rate has varied. So far in 2025, the typical low double-digit pace of decline in 2024 has dropped to a high single digit.

Ongoing Rise of HPHT

One element leading to the declines is the increased presence of High Pressure, High Temperature (HPHT) created goods. Once the source of primarily smaller goods due to technical limitations, now HPHT is the source of the majority of LGDs weighing up to 1.50 carats.

HPHT is a much lower cost process that results in higher color lab-grown diamonds. The outcome is a current anomaly in the market where 1-carat, HPHT, D VVS rounds are trading in the market below the prices of lower color and clarity goods.

Oddly, most retailers don’t care if the loose lab diamonds they procure are HPHT or Chemical Vapor Deposition (CVD), although they could save on their costs.

Fancy Shape Prices Holding

Another ongoing wholesale price trend is the slower drop in prices of fancy-shaped LGDs, although ovals remain very popular. Their declines were in the lower to mid-single digits in the second quarter.

In the US consumer market, accounting for the majority of global demand, 2-carat lab diamonds are the most popular size, but 3-carat diamonds are in growing demand.

As the market typically behaves, the steepest price drops occur when supply pushes the envelope in size, color, and clarity. With the rise in popularity among consumers, and as technical ability improves at growers, supply is increasing, leading to price declines along the pipeline – rough LGD prices drop, and in turn wholesale polished trading prices and retail prices fall too.

Three-Carat Price Crashing

This cascading price trend is now affecting 3-carat lab-grown diamonds, resulting in a deep wholesale price decline. Year on year, lab-grown diamond wholesale prices are down more than 50%, after losing more than 13% of their wholesale price in the last quarter alone.

The third and newest trend that seems to be emerging is a decline in the submission of lower color and clarity goods to labs for gemological reports.

The prevalence of GH color and SI clarity lab-grown diamonds with a lab report is declining, primarily due to lower prices. As prices decrease, manufacturers prefer to save on the cost of a lab report and offer the goods without one.

Another area where lab-grown diamond wholesale prices fell sharply as part of the cascading effect are round, 1-carat, D VVS goods, which dropped 27% quarter on quarter.

Overall, 1-carat round prices fell more than 20% during the three-month period.

US Retailers’ Costs

The Lab-Grown Diamond Wholesale Price List represents wholesale market trading rather than retail costs. The average cost paid by retailers for a round, 1-carat, IGI-certified LGD was $191 per carat, almost double the wholesale market trading price.

US retailers’ June cost was down 32% year on year.

The larger the diamond, the greater the markup. In Q2 2025, US retailers paid $225 for a 2-carat lab diamond, more than double the market trading price, and also a decrease of more than 30% year on year.

With the cost reduction, US jewelry retailers had a decline of about 30% in their expenditure on loose LGD year on year, and the value of their inventory declined with it.

Wholesalers should take note that a +100% markup provides plenty of room to lower prices, and they should expect retailers to continue to press for it.

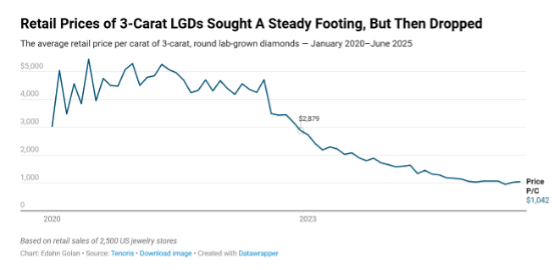

US Retail Prices

Both wholesalers and retailers have remarkably high gross margins on lab-grown diamond wholesale prices. US jewelry dealers have high markups over their LGD costs, resulting in an average gross margin of 74% for 1–3 carat rounds, which is up nearly 8% year on year.

The increase in gross margins is not leading to larger gross profits. On the contrary, the decline in the retail price and retailers’ cost is faster than the rise in gross margins.

According to data collected by Tenoris, the top-selling lab grown diamond in the second quarter was a 2.23-carat, round, E/VS1, accounting for more than 20% of lab grown diamond sales. These items sold on average for $917 per carat, a gross margin of 74%.

LGD Background, Price, and Trend Data

In an effort to provide regular data on lab-grown diamonds, we have created a Lab-Grown Diamond Statistics center. It includes updated retail and wholesale prices, background data, and analysis of the market.

Information on additional LGD services is available here.

About The LGD Wholesale Price List

The LGD Wholesale Price List was launched in October 2018 in response to requests from diamond industry companies to track and understand lab-grown diamond wholesale pricing. It originally tracked transaction prices of parcels of uncertified loose LGD sold by polishers at the market’s lowest pricing.

As the lab-grown diamond market evolved, the price list became more focused on transaction prices for larger certified lab-grown diamonds in nice makes. Prices are for small volume purchases.

The bulk of lab-grown diamonds weighing two carats or more are CVD. Goods under 2 carats include CVD and HPHT, with HPHT-made LGDs trading at a discount to CVD-made LGDs.

Subscribe to the LGD Wholesale Price List here.

Lab-Grown Diamond Wholesale Price List Q2 2025