New York— Tariffs, China’s slowdown, and geopolitics may dominate the jewelry industry’s headlines, but two less visible forces are quietly causing even greater disruption: currencies and commodities. And right now, they’re pulling in opposite directions—leaving diamond players caught in the crossfire.

Dollar Down, Gold Up

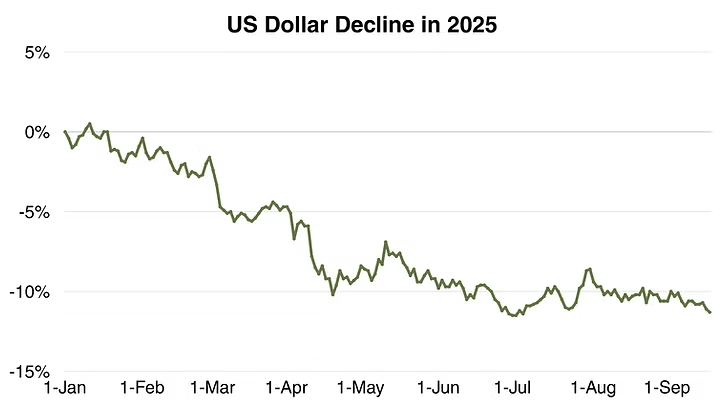

Since January, the U.S. dollar has fallen 11% on the ICE Dollar Index, while gold has smashed records above $3,650 per ounce. It’s a classic investor play: when the dollar weakens, money rushes to gold. But for the diamond pipeline, the fallout is anything but classic—it’s destabilizing.

Unlike gold or oil, diamonds aren’t exchange-traded commodities. Prices are set in tenders, contracts, and backroom negotiations, making the impact of currency swings messy and uneven.

Based on changes in ICE US Dollar Index. Data sourced from investor.com.

Miners Under Pressure

Take De Beers. It sells in dollars but pays expenses in South African rand and Botswana pula—currencies that have strengthened this year. That means every dollar of revenue translates into fewer local units, while costs balloon in dollar terms.

De Beers projects $94 per carat in average unit costs for 2025, up from $92 last year. On paper, costs look higher even though actual local spending hasn’t changed. It’s a squeeze born not from operations, but from currency.

Manufacturers in Conflict

For manufacturers, the picture should be brighter. Rough is bought in dollars, polished is exported worldwide. A weaker dollar theoretically lowers import costs and boosts export competitiveness.

But in India—the heart of cutting and polishing—the rupee has weakened 5% against the dollar this year. Rough imports are suddenly more expensive, while U.S. tariffs of 50% on Indian polished goods wipe out any advantage. Smaller cutting centers, with lighter tariff burdens, are eating India’s lunch.

Gold’s Relentless Rise

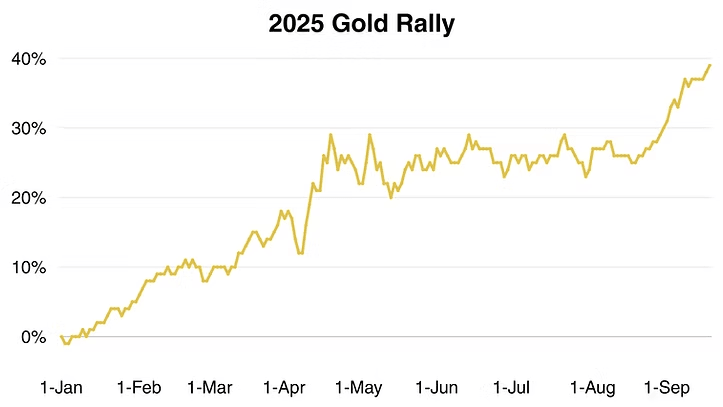

Then there’s gold—the real disruptor. Its record-breaking rally means the metal now eats up more of the cost of a jewelry piece, leaving less space in the budget for diamonds.

The consequences are clear:

- Signet Jewelers reported flat inventory values year-over-year, despite gold costs rising 30%. Diamonds are being squeezed out.

- World Gold Council data shows jewelry demand by volume fell 7% in Q2 to 30 tonnes, but value soared 30% to $3 billion. Consumers are spending more, but getting less metal.

The equation is brutal: more money is going to gold, while diamonds fight to remain relevant.

Based on changes in US dollar spot gold price. Data sourced from investor.com.

Regional Divide

In China and India, consumers rushed to buy gold as prices climbed, helping offset weaker diamond sales. But in the U.S., gold’s rise adds yet another headwind. Jewelers are forced to trim carat weight, redesign pieces, and somehow keep diamonds desirable without blowing up margins.

The Balancing Act

The diamond industry now faces a paradox: a weaker dollar and soaring gold should benefit commodities, but diamonds—never a standardized asset—are stuck between the two forces. With costs up, tariffs biting, and gold stealing the spotlight, can natural diamonds still compete? Or will consumers continue shifting toward alternatives like lab-grown diamond?